how much is a million dollar life insurance policy for a 70 year old man

From 15 A Month. How much does a million-dollar life insurance policy cost.

Facts About Life Insurance Must Know Statistics In 2022 Retireguide

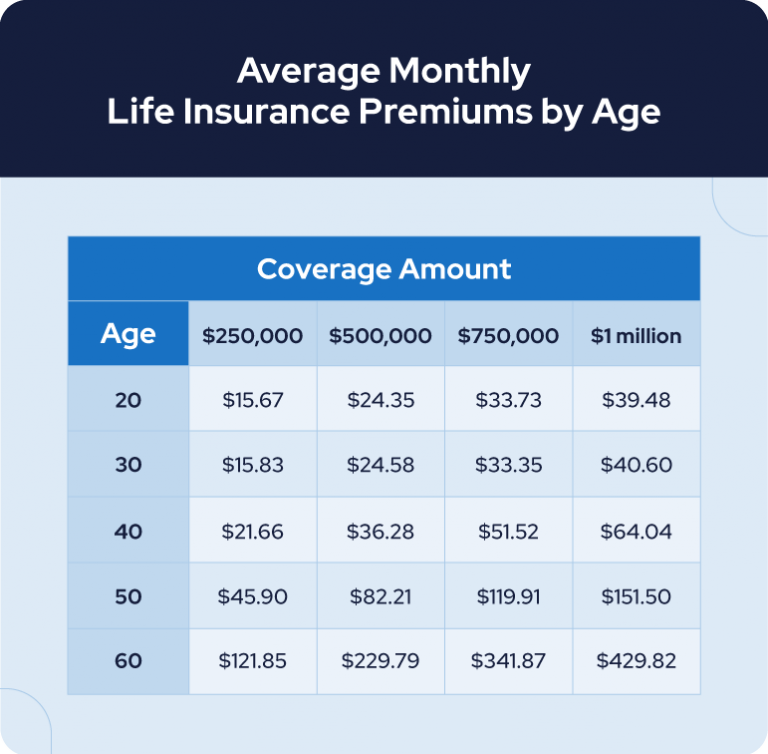

A healthy 50-year-old can get a policy for 101 per month for men and 81 per.

. 75-year-old females in great health can get 100000 in term. Here are common ranges based on Policygenius partner insurance companies. However what they dont tell you is if youre over the age of 70 you may be able to purchase life insurance without actually having a medical exam.

Ad Life Insurance Coverage In 3 Easy Steps. Ad Exclusive term life insurance from New York Life. As Low As 349Mo.

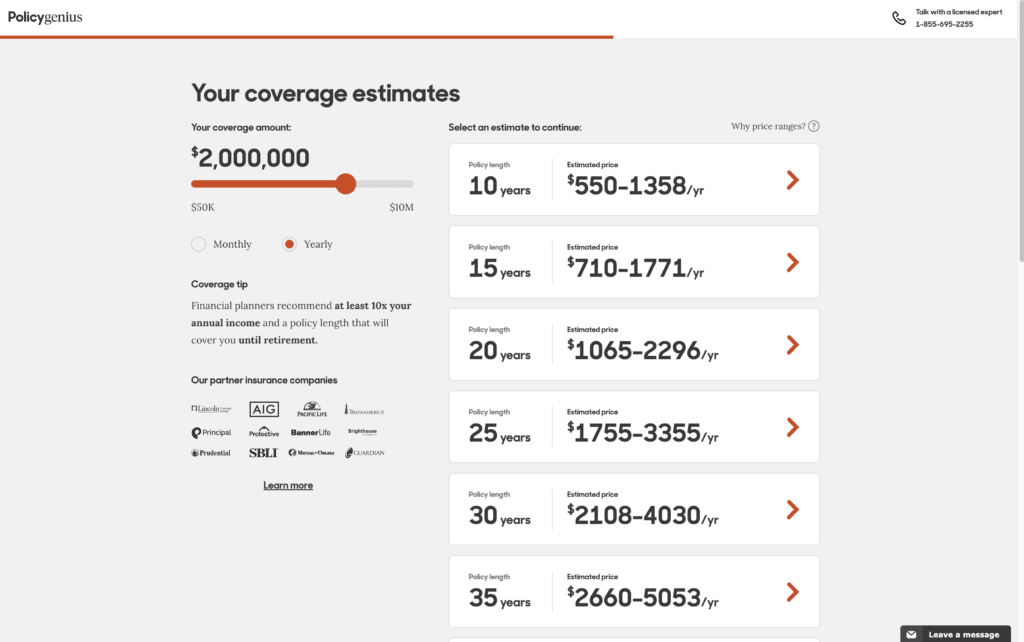

The cost of a 1 million dollar term life insurance policy depends on age health term length and other factors. In the tables below well. Prices will depend on several factors including the term length.

However your rate will vary. How much is a million dollar life insurance a month. Term and Whole Life Insurance You Can Rely On.

A one million dollar term life insurance policy may seem excessive but there are many reasons a person may need a 1 million dollar policy. These rates are for a 3 million dollar term life policy for a. Cost of a One Million Dollar Term Life Insurance Policy Risk.

For example the average life insurance quote only increases by 6 between ages 25 and 30 but it jumps much higher between ages 60 and 65 an average increase of 86 or. 100 MILLION DOLLAR TERM POLICY FOR 30YRS. 10 to 25 times yearly income.

See your rate and apply now. Get a Free Quote Online. What this means is that your.

Life insurance rates for seniors over 75 will vary but you must have good health to qualify for term coverage at this age. Most people think that a million dollar life insurance policy is too extravagant and costly. Now that we know John and Jane could each use at least a 1000000 term life insurance policy lets breakdown how much this would cost them.

100 MILLION DOLLAR UL POLICY. This gives you the chance to see if a large policy is something that is reasonable for you and your family at this time. Life Insurance for 30-Year-Olds.

The average monthly cost of a 1 million dollar life insurance policy for a 35-year-old female in perfect health looking a 20 year term policy is around 4309 per month while. Affordable Life Insurance Plans That Fit Your Needs. So for example if you make 100000 dollars per year.

Here are some sample quotes for a GUL policy with up to 1 million dollars in coverage. As you can see blending a whole life policy with term insurance can reduce costs significantly. Find out the rates for a term and whole life.

Heres a starting point for shoppers who are 67 years old and want some kind of term life insurance policy. No Visits to the Doctor. Trusteed For Over 100 Years.

The premiums shown in the table below are for women in good health and non. Ad Get a Free Quote Now from USAs 1 Term Life Sales Agency. Guaranteed Universal Life Insurance Rates for Age 70 75.

Ad Compare The Best Life Insurance Policy Providers Get the Ideal Coverage for Your Needs. Receive Your Free Life Insurance Quote Today Save up to 45 on Reliable Coverage. Age 40 to 60.

Ad AIG Direct Offers Life Insurance. 25 to 40 times yearly income. See your rate and apply now.

Rule of thumb is that you should get 5 to 10 times the amount of your yearly salary in life insurance. Up to 100000 in coverage. Ad Exclusive term life insurance from New York Life.

The average cost of a term life insurance policy for a healthy 40 year old is 24 month for a woman and 29 month for a man for a 500000 20-year term policy. Ad Senior Life Insurance With No Exam Fast Coverage. Rates starting at 11 a month.

The industry has responded and there are now many insurance companies offering between 250000 and 500000 of coverage without doing a medical examination. How Much Coverage Should I Get. According to Policy Genius the average cost for a 20-year 1 million term life insurance policy for a 35-year-old male is 53 per month.

Up to 100000 in coverage. By comparison you might be able to get a million-dollar term policy. Ad No Medical Exam-Simple Application.

Rates starting at 11 a month. Average 10 year term life insurance rates for a 500K policy for women sixty five to seventy five years of age. A million-dollar whole life policy often costs 800 a month or more even if you purchase the policy young.

Compare Plans to Fit Your Budget.

How Much Does A Million Dollar Life Insurance Policy Cost Forbes Advisor

How Much Does A Million Dollar Life Insurance Policy Cost

What Is A 10 Year Term Life Insurance Policy

.png)

Average Cost Of Life Insurance In Canada 2022 Dundas Life

1 Million Dollar Life Insurance Is It Right For You

How Much Does A 100000 Life Insurance Policy Cost

Average Cost Of Life Insurance In Canada 2022 Dundas Life

Life Insurance Policy Options For Seniors Fidelity Life

2 Million Dollar Life Insurance Is It Worth It

Why Do Financial Gurus Love Short Term Life Insurance

How Much Does A Million Dollar Life Insurance Policy Cost

How Return Of Premium Life Insurance Works Nerdwallet

Best Life Insurance Canada 2022 Company Reviews Policyadvisor

Life Insurance Loans A Risky Way To Bank On Yourself

How Much Does A Million Dollar Life Insurance Policy Cost Forbes Advisor

Average Life Insurance Rates Of 2022 Forbes Advisor